An estimated 27 million tonnes of the world’s commercially harvested seafood are discarded each year. In some fisheries, discard levels can reach upwards of 66% of total catch[1], contributing to the loss of marine biodiversity and depletion of important fish stocks. The environmental and economic cost to the planet is significant: as oceans are depleted, coastal communities suffer, and the demand in food supply is left unmet.

While newly enacted legislation in the E.U. seeks to eliminate discarding of unwanted fish catches at sea, a lack of technical solutions that enable more selective harvesting of target species have made compliance with the new laws challenging, even as the fishing industry is strongly committed to responsible fishing practices.

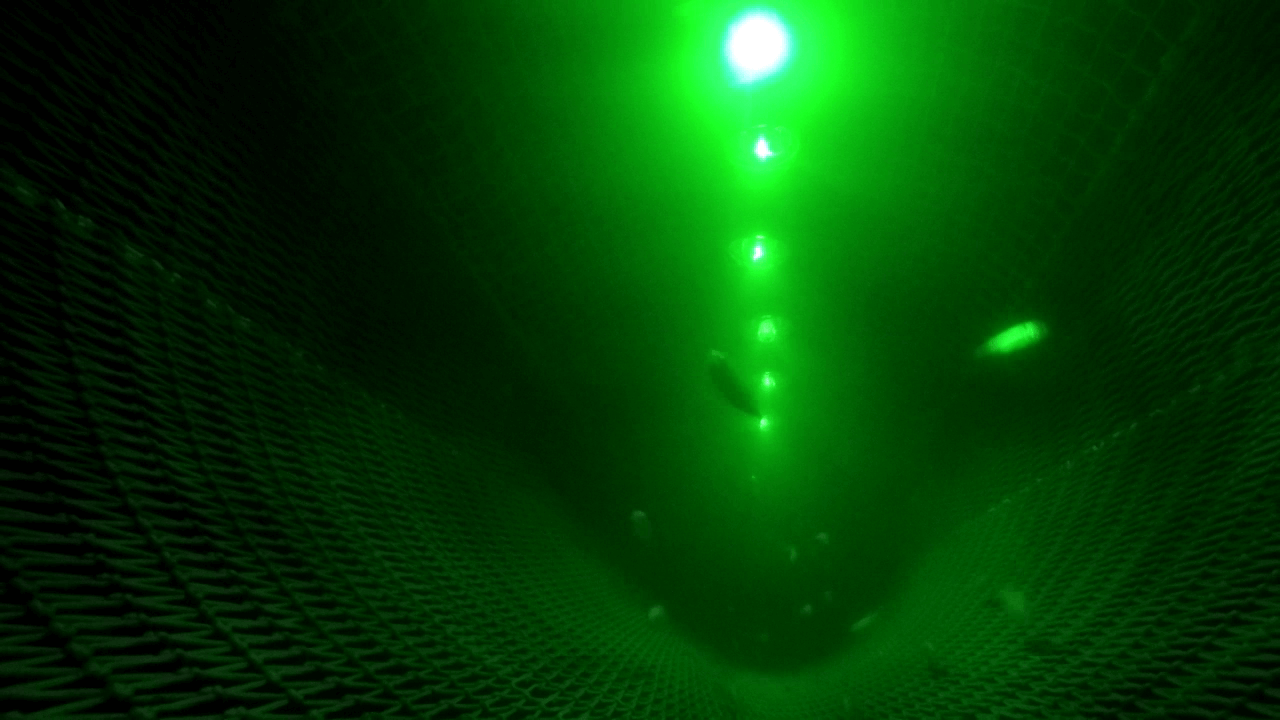

SafetyNet Technologies’ flagship product, Pisces

SafetyNet Technologies’ flagship product, Pisces

SafetyNet Technologies LTD, a UK company led by CEO Dan Watson, COO Nadia Laabs and CTO Aran Dasan, specialises in sustainable technologies for the fishing industry. In close collaboration with the fishing industry and leading scientific researchers, the company has developed innovative and effective solutions to these global fishing challenges. SafetyNet Technologies’ flagship product, Pisces, uses artificial light technology to alter the behaviour of fish and other marine species, which has been demonstrated to reduce unwanted bycatch by upwards of 60%[2] while increasing fishing revenues. This programmable LED device can be fitted to a range of commercial fishing gear types and has been successfully field-tested with a variety of commercial fish species.

Pisces in use in Spain

Pisces in use in Spain

In addition to promoting the overall economic and environmental sustainability of the fishing industry, Pisces is designed to improve the effectiveness and performance of fishing operations by increasing the proportion of target species harvested per vessel trip, reducing sorting time, and facilitating compliance with fishing regulations.

To address growing industry demand for its Pisces technology, SafetyNet Technologies recently raised £1.1 m ($1.5 m) in seed round financing from impact investors, Mirova (through the Althelia Sustainable Ocean Fund[3]), Mustard Seed VC and Conservation International Ventures. The proceeds of the financing will be used to scale the company’s manufacturing capacity, grow its sales and marketing activities, and expand its customer service teams.

SafetyNet Technologies’ founders, Dan, Aran, and Nadia

SafetyNet Technologies’ founders, Dan, Aran, and Nadia

Nadia Laabs, SafetyNet Technologies’ Chief Operations Officer, comments: “We are delighted to receive the support of leading sustainability impact investors such as Conservation International Ventures, Mirova Natural Capital and Mustard Seed. This seed financing will allow us to signficantly accelerate the commercial scale-up of our technologies and the positive impacts our Pisces technology is designed to deliver both for the global fishing industry and ocean health.”

David Barley, Blue investment director, Mirova Natural Capital, adds “We are really happy to come onboard as we believe Pisces is a trusted and scalable solution that will have a real impact on the profitability of commercial fishing businesses and ultimately protect a vital future food source for all, through fishing much more selectively.”

Alex Pitt, Co-Founder of Mustard Seed stated, “Billions of fish are being thrown away each year, adversely impacting biodiversity, fishing communities and food security – and with $6.6 billion in value lost annually. SafetyNet Technologies’ ground-breaking technology is shining a light on this massive challenge and is a prime example of the types of business we love to support, with a lock-step relationship between commercial success and very deep environmental impact.”

Jan Yoshioka, Director of Ocean Investments for Conservation International Ventures LLC, notes: “SafetyNet Technologies’ bycatch reduction technologies have extraordinary potential to improve protection of marine biodiversity while enhancing the ecological and economic sustainability of the world’s most important wild fish stocks. With positive environmental and social impact at the core of its value propositions, our investment in SafetyNet Technologies is strongly reflective of the type of investment our Conservation International Ventures fund was designed to support.”

The SafetyNet Technologies team

The SafetyNet Technologies team

Link to SafetyNet Technologies & Pisces images

Link to SafetyNet Technologies: Making Fishing Brighter Video

SafetyNet Technologies Ltd.

Nadia Laabs, Chief Operations Officer

Tel. +44 20 7052 3903

Conservation International Ventures

Jessica Brown, Media Relations Specialist

Tel. +1 734 748 7361

Mirova

Billie Clarricoats – Natixis Investment Managers

Tel. +44 20 3405 2189

billie.clarricoats@natixis.com

Mustard Seed

Alex Pitt, Director of Growth

Tel. +44 7585 813717

About SafetyNet Technologies Ltd.

SafetyNet Technologies is a UK-based SME, focused on increasing sustainability in the commercial fishing industry. Current fishing processes and technologies can be very unselective, leading to the capture of the wrong species and ages of fish and their subsequent wastage. We aim to make the fishing industry smarter through technology development to accelerate scientific research, applying its findings in the form of user-friendly electro-mechanical devices and new fishing practices. www.sntech.co.uk

About Mustard Seed VC

Mustard Seed seeks to enable the creation of world-class businesses that generate positive and

sustainable outcomes. With our European and UK focused funds we connect a dynamic and influential network of global members with exceptional entrepreneurial talent across the world. We believe that solving big social and environmental problems drives commercial success in the long run. www.mustardseed.vc

About Conservation International Ventures

Conservation International Ventures LLC (“CI Ventures”) is an impact-first investment fund that seeks to generate positive, quantifiable conservation outcomes alongside financial returns. CI Ventures supports small and medium enterprises whose value propositions reinforce and enhance the value of natural capital, promote sustainable and regenerative food production, and advance nature-based solutions to environmental challenges in the regions where we invest. CI Ventures is managed by Conservation International (“CI”) a leading U.S. based environmental conservation organization working in more than 30 countries on six continents to ensure a healthy, prosperous planet that supports us all. www.conservation.org/projects/conservation-international-ventures-llc

About Mirova

Mirova is an investment manager dedicated to responsible investment. Through a conviction-driven investment approach, Mirova’s goal is to combine value creation over the long term with sustainable development. Mirova’s talents have been pioneers in many areas of sustainable finance. Their ambition is to keep innovating to propose the most impactful solutions to their clients. www.mirova.co.uk

Mirova is a Portfolio management company – French Public limited liability company

RCS Paris n°394 648 216 – Regulated by AMF under n° GP 02-014

59, Avenue Pierre Mendes France – 75013 – Paris

Mirova is an affiliate of Natixis Investment Managers.

Mirova Natural Capital Limited is a UK Private limited company

Company registration number: 7740692 – Authorized and Regulated by FCA

Registered office: 15-19 Bloomsbury Way, London, WC1A 2TH

The services of Mirova Natural Capital Limited are only available to professional clients and eligible counterparties. They are not available to retail clients. Mirova Natural Capital Limited is wholly owned by Mirova.

About Natixis Investment Managers

Natixis Investment Managers serves financial professionals with more insightful ways to construct portfolios. Powered by the expertise of 24 specialized investment managers globally, we apply Active ThinkingSM to deliver proactive solutions that help clients pursue better outcomes in all markets. Natixis ranks among the world’s largest asset management firms1 (€898,2 billion assets under management2). Headquartered in Paris and Boston, Natixis Investment Managers is a subsidiary of Natixis and includes all of the investment management and distribution entities affiliated with Natixis Distribution, L.P. and Natixis Investment Managers S.A. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Provided by Natixis Investment Managers UK Limited which is authorised and regulated by the UK Financial Conduct Authority (register no. 190258). Registered Office: Natixis Investment Managers UK Limited, One Carter Lane, London, EC4V 5ER.

1 Cerulli Quantitative Update: Global Markets 2019 ranked Natixis Investment Managers (formerly Natixis Global Asset Management) as the 17th largest asset manager in the world based on assets under management as of December 31, 2018.

2 Net asset value as at June 30, 2019. Assets under management (“AUM”), as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

[1] Source: Oceana Wasted Catch Report: Amanda Keledjian, et al: https://oceana.org/sites/default/files/reports/Bycatch_Report_FINAL.pdf

[2] Source : https://youngsseafood.co.uk/fish-for-life-news/project-trawllight/

[3] ALTHELIA SUSTAINABLE OCEAN FUND is a Specialized Investment Fund incorporated as a Luxembourg Limited Partnership with shares (SCA SICAV SIF), open to subscription to eligible investors as defined by the fund’s regulation. Alter Domus Management Company is the management company and Mirova Natural Capital is the financial sub-advisor. This fund is approved by the Luxembourg Commission for the Supervision of the Financial Sector (the “CSSF”).

Enter the giveaway below for the chance to try an underwater camera on your fishing vessel for free.